KRONUS VENTURESCollateralized Financing

Collateralized Financing

Collateralized financing represents one of the most robust frameworks in modern investment strategy, providing a secure foundation for capital deployment even in volatile markets.

Collateralized financing refers to financial arrangements where loans or investments are backed by specific assets pledged as collateral. This fundamental concept—dating back centuries in traditional finance—has evolved into a sophisticated risk management framework proven globally at scale.

Collateralized Financing Strategies in Practice

Secured Lending Operations

Our fund deploys capital through carefully structured lending operations where:

- Loans are secured by cryptocurrency collateral at conservative loan-to-value ratios (typically 40-60%)

- Collateral is held in segregated, insured custody solutions with institutional-grade security

- Automated monitoring systems track collateral values in real-time

- Multi-signature security protocols govern all collateral movements

- Lending terms include robust covenants and regular collateral verification requirements

This approach generates consistent yield while maintaining strict risk parameters that limit downside exposure.

Collateralized Derivative Structures

We construct sophisticated derivative positions using collateral-backed frameworks:

- Options strategies secured by underlying digital assets

- Futures positions with transparent margining requirements

- Swap arrangements with established counterparties and clear collateral terms

- Structured products with explicit collateralization rights

These strategies enable targeted exposure to specific market opportunities while maintaining the security of collateralized positions.

Strategic Liquidity Provision

Our fund participates in market-making and liquidity provision secured by comprehensive collateral arrangements:

- Deployment of capital across strategic trading venues with explicit collateral security

- Provision of liquidity to decentralized protocols with transparent risk parameters

- Participation in secured interbank lending markets for digital assets

These activities generate alpha through spread capture while securing all positions through robust collateralization.

The Strategic Advantage of Collateralized Financing in Crypto

Enhanced Security Through

Asset-Backed Positions

Unlike unsecured investments that rely solely on counterparty promises, our collateralized financing approach ensures every position is backed by tangible assets. This creates multiple layers of protection:

- Immediate Recourse: In adverse scenarios, collateral can be liquidated to recover capital

- Reduced Counterparty Risk: Reliance on creditworthiness is supplemented with asset security

- Structural Protection: Legal frameworks provide clear ownership rights to collateral assets

This multi-layered security framework is especially valuable in cryptocurrency markets, where regulatory protections remain in development and counterparty risk assessment can be challenging.

Optimized Capital Efficiency

Collateralized financing enables sophisticated investors to:

- Maintain Market Exposure: Core crypto positions can be maintained while simultaneously generating yield

- Enhance Returns: Leverage can be employed within strictly controlled risk parameters

- Access Liquidity Without Exiting Positions: Monetize assets without triggering taxable events or abandoning strategic positions

Our proprietary collateralization models dynamically adjust based on asset volatility profiles, ensuring optimal capital efficiency without compromising risk standards.

Institutional-Grade Risk Management

By implementing collateralized structures, we transform the risk profile of cryptocurrency investments:

- Quantifiable Downside Limits: Maximum loss scenarios are clearly defined through collateralization ratios

- Early Warning Systems: Margin requirements provide systematic indicators of market stress

- Controlled Liquidation Protocols: Predefined processes ensure orderly position management during extreme volatility

This systematic approach replaces the binary risk profile of direct crypto ownership with a carefully engineered risk curve that can be precisely calibrated to investor objectives.

Best Practices in Collateralized Crypto Financing

Diversification of Collateral Assets

Our risk management framework requires diversification across multiple dimensions:

- Asset Diversification: Exposure limits to individual cryptocurrencies within collateral pools

- Custodial Diversification: Distribution of collateral across multiple institutional-grade custody solutions

- Jurisdictional Diversification: Strategic allocation of collateral across regulatory environments

- Counterparty Diversification: Limits on exposure to individual borrowers or counterparties

This multilayered diversification creates resilience against both asset-specific and systemic risks.

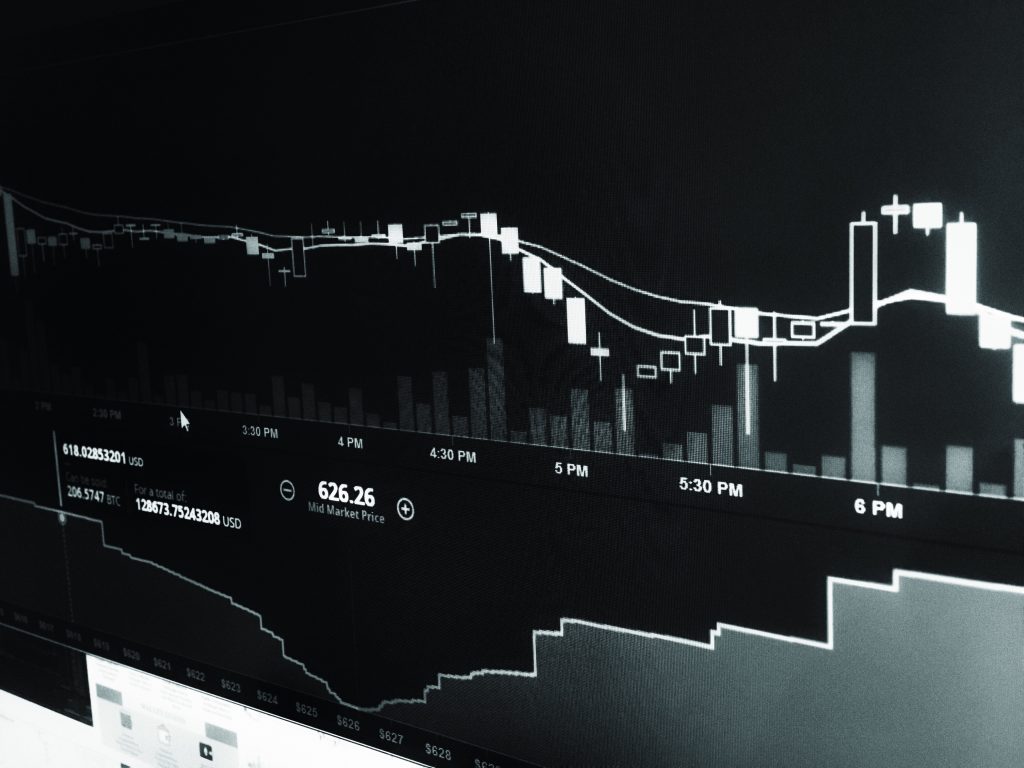

Dynamic Collateral Valuation

We employ sophisticated real-time valuation methodologies:

- 24/7 monitoring of collateral values across multiple price sources

- Volume-weighted averaging to mitigate pricing anomalies

- Volatility-based haircuts that adjust collateralization requirements dynamically

- Stress testing against historical volatility scenarios and black swan events

- Regular independent valuation verification by third-party specialists

These practices ensure collateral valuations remain accurate even during extreme market conditions.

Proactive Margin Management

Our operations are built around proactive risk monitoring:

- Automated early warning systems for collateral value fluctuations

- Predefined margin call procedures with clear escalation protocols

- Tiered margin requirements that increase conservatism as positions grow

- Regular stress testing of margin models against extreme scenarios

- Liquidity reserves maintained specifically for margin requirement management

This approach ensures positions remain appropriately collateralized through all market conditions.

Regulatory Compliance Integration

We maintain comprehensive regulatory compliance:

- Jurisdictional analysis of collateral arrangements and enforceability

- KYC/AML procedures for all counterparties in collateralized transactions

- Tax efficiency analysis of collateral structures and transactions

- Regular compliance reviews of all collateralized positions

- Proactive engagement with regulators on emerging standards

Our compliance-first approach ensures collateral arrangements remain robust and enforceable.

Continuous Market Monitoring

Our investment team maintains dedicated coverage of factors affecting collateralized financing:

- Regulatory Developments: Tracking evolving frameworks for crypto-backed lending and collateralization

- Technology Innovations: Monitoring advancements in smart contract-based collateral management

- Market Structure Evolution: Analyzing changes in liquidity patterns and market microstructure

- Custodial Security Enhancements: Evaluating emerging standards in digital asset custody

This intelligence gathering ensures our collateralization strategies remain at the forefront of industry best practices.

Advanced Risk Analytics

Our quantitative team continuously refines our risk models:

- Historical scenario analysis across multiple crypto market cycles

- Monte Carlo simulations of collateral value fluctuations

- Agent-based modeling of liquidation cascades and market impacts

- Network analysis of collateral interconnectedness and systemic risks

These analytical tools allow us to anticipate emerging risks and adapt collateralization parameters proactively.

The Kronus Ventures Difference

While many investment managers are exploring cryptocurrency markets, few possess the specialized expertise required to implement institutional-grade collateralized financing programs. Our team brings together expertise from:

- Structured finance and securitization

- Derivatives trading and risk management

- Digital asset custody and security

- Regulatory compliance and legal frameworks

- Quantitative modeling and stress testing

This multidisciplinary approach allows us to create collateralized financing solutions that transform the risk-return profile of cryptocurrency investments.

Ready?

To Take the Next Step in Your Investment Evolution